How much is steam tax – Prepare to delve into the captivating world of steam tax, a topic that has sparked intrigue and debate for centuries. From its historical roots to its modern-day implications, this article will unravel the complexities of steam tax, shedding light on its impact on businesses, the economy, and the environment.

As we embark on this journey, we will explore the different types of steam tax, analyze its economic effects, and uncover its environmental implications. We will also delve into the intricacies of steam tax administration and compliance, ensuring a comprehensive understanding of this multifaceted subject.

Steam Tax Overview

Steam tax is a levy imposed on the use of steam-powered equipment. It has a long history, dating back to the early days of the Industrial Revolution. In the 19th century, steam engines were widely used to power factories, locomotives, and ships.

The steam tax was a way for governments to generate revenue from this new technology.

There are different types of steam tax. Some taxes are based on the amount of steam used, while others are based on the size or power of the steam engine. The tax rate can also vary depending on the jurisdiction.

Steam tax is still in use in some countries today. For example, the United Kingdom has a steam tax that is based on the amount of steam used.

Economic Impact of Steam Tax

Steam tax can have a significant impact on businesses that use steam-powered equipment. The tax can increase the cost of production, which can lead to higher prices for goods and services.

Steam tax can also affect the choice of technology that businesses use. Some businesses may choose to use alternative energy sources, such as electricity or natural gas, to avoid paying steam tax.

The economic impact of steam tax can be both positive and negative. On the one hand, the tax can generate revenue for governments. On the other hand, the tax can increase the cost of doing business and discourage the use of steam-powered equipment.

Environmental Implications of Steam Tax, How much is steam tax

Steam tax can also have environmental implications. By increasing the cost of using steam-powered equipment, the tax can discourage businesses from using this technology. This can lead to a reduction in air pollution and greenhouse gas emissions.

However, steam tax can also have negative environmental impacts. If businesses switch to alternative energy sources, such as coal or oil, this can lead to an increase in air pollution and greenhouse gas emissions.

The environmental impact of steam tax is complex and depends on a number of factors, such as the tax rate, the type of energy sources that businesses use, and the overall energy efficiency of the economy.

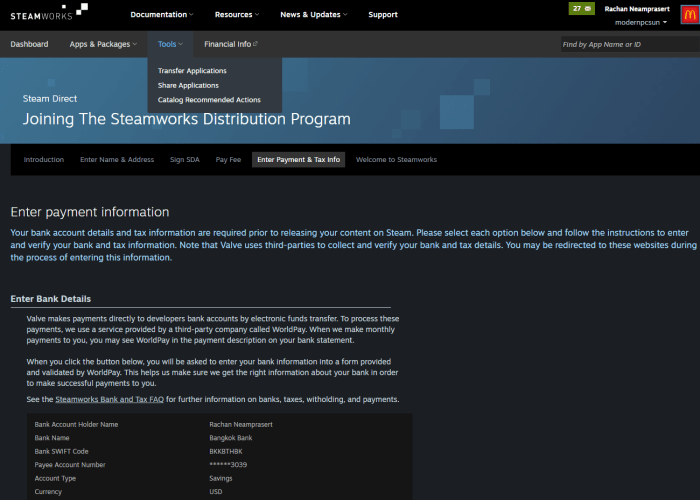

Steam Tax Administration and Compliance

Steam tax is administered and enforced by government agencies. These agencies are responsible for collecting the tax and ensuring that businesses comply with the regulations.

Steam tax compliance can be complex and challenging. Businesses need to be aware of the tax laws and regulations and ensure that they are taking the necessary steps to comply.

There are a number of best practices that businesses can follow to ensure compliance with steam tax regulations. These include:

- Keeping accurate records of steam usage.

- Filing tax returns on time.

- Paying taxes in full.

Steam Tax Reform and Policy Considerations

Steam tax policies are constantly being reviewed and reformed. Governments are looking for ways to make the tax more efficient and equitable.

There are a number of different approaches to steam tax reform. Some governments have opted to reduce the tax rate, while others have eliminated the tax altogether.

When considering steam tax reform, governments need to weigh the potential economic and environmental impacts. They also need to consider the administrative costs of collecting the tax.

Questions Often Asked: How Much Is Steam Tax

What is steam tax?

Steam tax is a tax levied on the use of steam-powered equipment or the consumption of steam.

How is steam tax calculated?

Steam tax is typically calculated based on the volume of steam consumed or the horsepower of steam-powered equipment.

What are the economic implications of steam tax?

Steam tax can impact businesses by increasing operating costs, affecting the cost of goods and services, and influencing investment decisions.