In the bustling metropolis of Los Santos, GTA 5 Online insurance serves as a lifeline for players navigating the treacherous streets and unforeseen mishaps. From protecting your prized vehicles to safeguarding your hard-earned cash, understanding the intricacies of insurance can make all the difference in your virtual endeavors.

Whether you’re a seasoned veteran or a newcomer to the online realm, this comprehensive guide will provide you with all the essential information you need to make informed decisions about GTA 5 Online insurance, ensuring that your assets are protected and your financial well-being is secure.

Overview of GTA 5 Online Insurance

Insurance in GTA 5 Online is a crucial aspect of the game, protecting players from financial losses and ensuring a smoother gaming experience. It covers various risks, including vehicle damage, property destruction, and personal injury. There are several types of insurance available, each with its own coverage and benefits.

Obtaining insurance is essential for every player. It provides peace of mind and financial security, allowing players to enjoy the game without worrying about unexpected expenses.

How to Get Insurance in GTA 5 Online

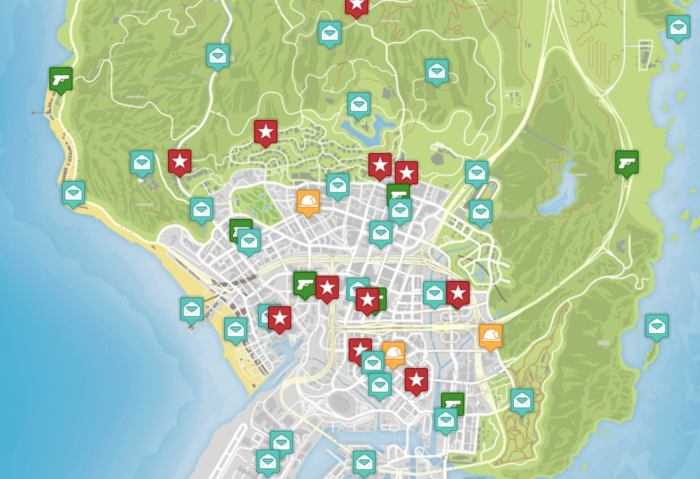

Purchasing insurance in GTA 5 Online is a straightforward process. Players can visit any insurance company located in Los Santos or Blaine County. Upon entering the insurance company, players can interact with the receptionist and select the type of insurance they wish to purchase.

Insurance premiums can be paid in various ways. Players can use cash, their bank account, or their credit card. Once the premium is paid, the insurance policy will become active, providing coverage for the specified period.

In case of an incident, players can file a claim by calling the insurance company or visiting their website. The claim process involves providing details of the incident, such as the time, location, and nature of the damage.

Coverage and Exclusions

Each type of insurance in GTA 5 Online provides different coverage. Vehicle insurance, for example, covers damage to the player’s vehicle caused by accidents, collisions, and explosions. Property insurance covers damage to the player’s property, such as their apartment or garage.

It’s important to note that there are exclusions to coverage. For instance, vehicle insurance may not cover damage caused by intentional acts or racing. Property insurance may not cover damage caused by natural disasters or acts of war.

Coverage limits also apply. For example, vehicle insurance may have a maximum payout limit for repairs. It’s crucial to understand the coverage and exclusions of each insurance policy before purchasing it.

Cost of Insurance

The cost of insurance in GTA 5 Online varies depending on the type of insurance, the coverage level, and the player’s driving or property history. Vehicle insurance premiums are typically based on the value of the vehicle and the player’s driving record.

Factors that can affect the cost of insurance include the player’s age, gender, and location. Younger players and those with poor driving records may pay higher premiums. Players can reduce the cost of insurance by maintaining a good driving record and avoiding accidents or claims.

Benefits of Insurance

Having insurance in GTA 5 Online offers numerous benefits. It provides financial protection against unexpected expenses, allowing players to save money in the long run. Insurance can also give players peace of mind, knowing that they are covered in case of an incident.

For example, if a player’s vehicle is damaged in an accident, insurance can cover the cost of repairs, preventing the player from having to pay out of pocket. Similarly, property insurance can protect players from financial losses if their property is damaged or destroyed.

Examples of Insurance Claims: Gta 5 Online Insurance

In GTA 5 Online, players can file insurance claims for various incidents, including vehicle damage, property damage, and personal injury. Here are some real-world examples of insurance claims that have been filed:

- A player’s vehicle was damaged in a collision with another player. The player filed a claim with their insurance company, which covered the cost of repairs.

- A player’s apartment was destroyed in an explosion. The player filed a claim with their property insurance company, which covered the cost of rebuilding the apartment.

- A player was injured in a car accident. The player filed a claim with their personal injury insurance company, which covered the cost of medical expenses and lost wages.

Tips for Managing Insurance

To manage insurance effectively in GTA 5 Online, players should follow these tips:

- Compare insurance quotes from different insurance companies to find the best coverage at the most affordable price.

- Maintain a good driving or property history to reduce insurance premiums.

- Consider increasing the coverage limits on your insurance policies to ensure adequate protection.

- File insurance claims promptly after an incident to avoid any delays in processing.

Question & Answer Hub

What is the purpose of insurance in GTA 5 Online?

Insurance protects your vehicles and other assets from damage or destruction, providing financial compensation in the event of an accident or other covered event.

How do I purchase insurance in GTA 5 Online?

You can purchase insurance from any insurance company located throughout Los Santos. Simply drive your vehicle to the insurance company and select the desired coverage plan.

What are the different types of insurance coverage available?

GTA 5 Online offers a range of insurance coverage options, including vehicle insurance, property insurance, and health insurance. Each type of coverage provides specific benefits and exclusions.

How do I file an insurance claim?

To file an insurance claim, contact your insurance company and provide details of the incident. The insurance company will investigate the claim and determine the appropriate compensation.