GTA 5 Augury Insurance is an essential component of the game, providing players with financial protection against vehicle damage or loss. It offers a range of insurance policies with varying coverage and benefits, allowing players to tailor their coverage to their individual needs.

Understanding the intricacies of Augury Insurance is crucial for maximizing its benefits. This guide delves into the various types of insurance policies available, the process of obtaining coverage, filing claims, and potential limitations and exclusions. By providing comprehensive information, players can make informed decisions about their insurance needs and safeguard their in-game assets.

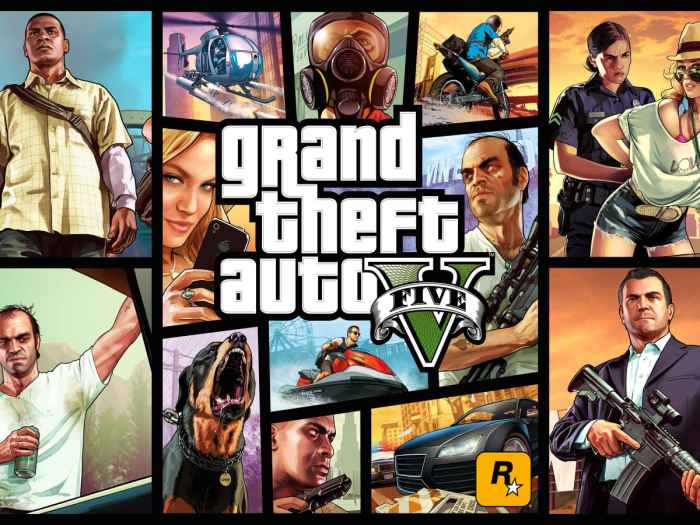

Introduction to GTA 5 Augury Insurance

Augury Insurance is an in-game insurance company in Grand Theft Auto V (GTA 5) that provides players with financial protection against vehicle damage or loss. It offers a range of insurance policies tailored to the needs of players, ensuring peace of mind while navigating the dangerous streets of Los Santos.

Benefits of Using Augury Insurance

- Financial protection against vehicle damage or loss, reducing the financial burden of repairs or replacements.

- Savings on repair costs, as insurance coverage can significantly reduce the out-of-pocket expenses for vehicle repairs.

- Peace of mind while driving, knowing that you are covered in case of accidents or unexpected events.

How to Obtain Augury Insurance: Gta 5 Augury Insurance

- Visit an in-game insurance company, such as Mors Mutual Insurance or Los Santos Customs.

- Select the desired insurance policy that suits your needs and budget.

- Pay the insurance premium to activate the coverage.

Filing Insurance Claims

To file an insurance claim in GTA 5, follow these steps:

- Report the accident to the police or call Mors Mutual Insurance.

- Submit documentation, such as photos or videos of the damage, to the insurance company.

- Receive compensation for the covered damages, minus any applicable deductibles.

Note that insurance claims may be subject to delays or challenges, depending on the circumstances of the accident.

Limitations and Exclusions of Augury Insurance

Augury Insurance policies have certain limitations and exclusions:

- Coverage may not apply to damage caused by intentional acts, illegal activities, or racing.

- Insurance premiums and coverage amounts vary depending on factors such as the value of the vehicle and the driver’s history.

- It’s crucial to carefully review the terms and conditions of the insurance contract to understand the specific limitations and exclusions.

Comparison with Other Insurance Options

GTA 5 offers various insurance options, including Augury Insurance, Mors Mutual Insurance, and Los Santos Customs Insurance.

Each option has its own advantages and disadvantages, such as coverage, cost, and convenience. Players should compare these options and choose the one that best meets their individual needs and preferences.

FAQ Overview

What are the different types of insurance policies available in GTA 5 Augury Insurance?

GTA 5 Augury Insurance offers a range of policies, including basic coverage, comprehensive coverage, and collision coverage. Basic coverage provides protection against theft and damage caused by fire or explosions, while comprehensive coverage extends protection to vandalism, natural disasters, and accidents with other vehicles.

Collision coverage specifically covers damage resulting from collisions with other objects.

How do I file an insurance claim in GTA 5?

To file an insurance claim, players must report the incident to their insurance company and provide documentation such as a police report or repair estimate. The insurance company will then review the claim and determine the amount of compensation to be paid.

What are the limitations and exclusions of Augury Insurance?

Augury Insurance policies may have certain limitations and exclusions, such as coverage limits, deductibles, and exclusions for certain types of damage or accidents. It is important to carefully review the policy terms and conditions to understand the extent of coverage.