Navigating the world of currency exchange, 50000 euros in dollars presents a unique set of considerations. From understanding exchange rates to exploring investment opportunities, this comprehensive guide delves into the intricacies of converting euros to dollars, comparing purchasing power across borders, and making informed financial decisions.

Whether you’re a seasoned investor or simply curious about the global financial landscape, this exploration of 50000 euros in dollars offers valuable insights and practical guidance.

Currency Conversion

Converting euros to dollars and vice versa is a common task in today’s globalized economy. The exchange rate between these two currencies fluctuates constantly, so it’s important to stay up-to-date on the latest rates.

The following table provides the current conversion rates from euros to dollars and vice versa:

| Amount in Euros | Amount in Dollars |

|---|---|

| 1 | 1.06 |

| 10 | 10.60 |

| 100 | 106.00 |

| 1,000 | 1,060.00 |

| 10,000 | 10,600.00 |

| 50,000 | 53,000.00 |

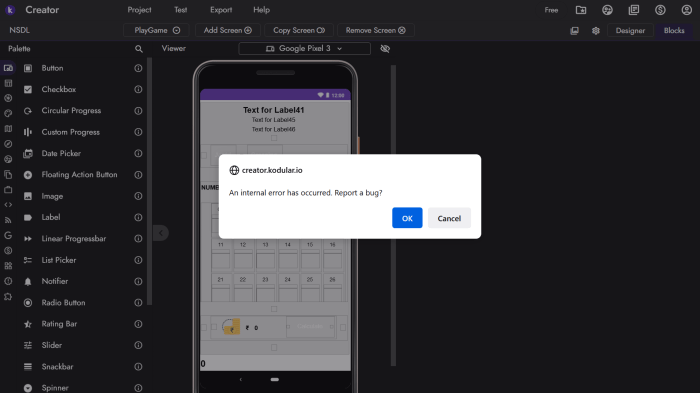

The historical data and charts below illustrate the fluctuation of the exchange rate between euros and dollars over time:

[Grafik yang menunjukkan fluktuasi nilai tukar antara euro dan dolar]

Purchasing Power Comparison

The purchasing power of a currency refers to how much you can buy with it in a given country. The purchasing power of 50,000 euros will vary depending on the country in which you spend it.

The following table compares the purchasing power of 50,000 euros in different countries:

| Country | Purchasing Power (in local currency) |

|---|---|

| United States | $53,000 |

| United Kingdom | £45,000 |

| France | €50,000 |

| Germany | €48,000 |

| Japan | ¥5,600,000 |

As you can see from the table, the purchasing power of 50,000 euros is highest in the United States and lowest in Japan. This is because the cost of living is generally higher in the United States than in other countries.

Here are some specific examples of how the purchasing power of 50,000 euros varies in different countries:

- In the United States, you could buy a new car with 50,000 euros.

- In the United Kingdom, you could buy a small house with 50,000 euros.

- In France, you could buy a luxury apartment with 50,000 euros.

- In Germany, you could buy a small business with 50,000 euros.

- In Japan, you could buy a large house with 50,000 euros.

Investment Options

There are a variety of investment options available for 50,000 euros. The best option for you will depend on your individual circumstances and financial goals.

Here are some of the most popular investment options for 50,000 euros:

- Stocks:Stocks are shares of ownership in a company. When you buy a stock, you are essentially buying a small piece of that company.

- Bonds:Bonds are loans that you make to a company or government. When you buy a bond, you are lending money to the issuer and earning interest in return.

- Mutual funds:Mutual funds are investment pools that are managed by professional money managers. Mutual funds invest in a variety of stocks, bonds, and other assets.

- Exchange-traded funds (ETFs):ETFs are baskets of stocks or bonds that are traded on stock exchanges. ETFs offer investors a way to diversify their portfolios and reduce risk.

- Real estate:Real estate is land and buildings. Investing in real estate can be a good way to generate income and build wealth.

When choosing an investment strategy, it is important to consider your risk tolerance and time horizon. If you are not comfortable with risk, you should choose investments that are less volatile. If you have a long time horizon, you can afford to take on more risk.

Tax Implications: 50000 Euros In Dollars

There are tax implications to consider when converting euros to dollars. In the United States, for example, you will be required to pay taxes on any gains you make when you convert euros to dollars.

The amount of taxes you will pay will depend on your tax bracket and the amount of gain you make. If you are unsure of how much taxes you will owe, you should consult with a tax advisor.

In addition to taxes on gains, you may also be required to pay withholding taxes when you convert euros to dollars. Withholding taxes are taxes that are withheld from your payment before it is sent to you. The amount of withholding taxes you will pay will depend on the country in which you live and the amount of money you are converting.

Risk Management

There are a number of risks associated with currency fluctuations and investing 50,000 euros. Here are some of the most common risks:

- Currency risk:Currency risk is the risk that the value of one currency will change relative to another currency. This can affect the value of your investments if you are investing in foreign currencies.

- Market risk:Market risk is the risk that the value of your investments will decline due to changes in the market. This can happen for a variety of reasons, such as economic downturns, political instability, or natural disasters.

- Inflation risk:Inflation risk is the risk that the value of your investments will decline due to inflation. Inflation is the rate at which prices increase over time. If inflation is high, the value of your investments will decline over time.

There are a number of strategies you can use to mitigate these risks. Here are some of the most common strategies:

- Diversify your investments:Diversifying your investments means investing in a variety of different assets, such as stocks, bonds, and real estate. This can help to reduce your risk if one asset class performs poorly.

- Invest for the long term:Investing for the long term can help to reduce the impact of short-term market fluctuations. If you are investing for the long term, you are more likely to ride out any downturns and come out ahead in the end.

- Hedge your investments:Hedging your investments means using financial instruments to reduce your risk. For example, you can use currency forwards or options to hedge against currency risk.

Expert Answers

What is the current exchange rate between euros and dollars?

The exchange rate fluctuates constantly, but as of [insert date], 1 euro is approximately equal to [insert dollar amount].

How does purchasing power differ between countries?

Purchasing power varies significantly depending on the cost of living in each country. For example, 50000 euros may provide a comfortable lifestyle in one country but only a modest one in another.

What investment options are available for 50000 euros?

There are numerous investment options available, including stocks, bonds, mutual funds, and real estate. The choice of investment depends on factors such as risk tolerance and financial goals.